sanliurfaescort.site

Learn

Loss Of Value Claim After Car Accident

Diminished value is the loss in your vehicle's value after a car accident. When an accident occurs, your vehicle suddenly has an accident history. In layman's terms, “diminished value” means the difference in value between a vehicle that has never been damaged and the same vehicle after it has been damaged. California allows you to file a claim to compensate for your car's diminished value after a car accident. The statute of limitations to file this type of claim. Damage to your car is not part of an injury claim, but you should still seek compensation for property damage and diminished value from the insurance. To receive compensation for diminished value, you must prove that another party's negligence caused the damage to your vehicle and the damage resulted in. Inherent diminished value claims describe the actual loss of the vehicle's market value. These occur when you make the necessary repairs to your car, but. You can file a diminished value claim against the insurer of the at-fault party. Best approach is to obtain a comprehensive appraisal. The difference in the market value of your car before it was in an accident and the market value after repairs due to an accident is the inherent diminished. Diminished value claims seek to ensure that the owner of the vehicle is compensated for the loss of value to his or her vehicle after an accident. Diminished value is the loss in your vehicle's value after a car accident. When an accident occurs, your vehicle suddenly has an accident history. In layman's terms, “diminished value” means the difference in value between a vehicle that has never been damaged and the same vehicle after it has been damaged. California allows you to file a claim to compensate for your car's diminished value after a car accident. The statute of limitations to file this type of claim. Damage to your car is not part of an injury claim, but you should still seek compensation for property damage and diminished value from the insurance. To receive compensation for diminished value, you must prove that another party's negligence caused the damage to your vehicle and the damage resulted in. Inherent diminished value claims describe the actual loss of the vehicle's market value. These occur when you make the necessary repairs to your car, but. You can file a diminished value claim against the insurer of the at-fault party. Best approach is to obtain a comprehensive appraisal. The difference in the market value of your car before it was in an accident and the market value after repairs due to an accident is the inherent diminished. Diminished value claims seek to ensure that the owner of the vehicle is compensated for the loss of value to his or her vehicle after an accident.

To determine the reduction in value if repairs cannot be made, you must determine the fair market value of the [e.g., automobile] immediately before the harm. The process involves obtaining an estimate for your car's value before and after the accident and including that information in your claim. Such claims are known as diminished value claims. As car accidents are incredibly common effects, filing a claim serves as a means of compensation. Normally. Inherent diminished value. This type of value loss occurs when a vehicle damaged in a crash is repaired to its original condition, but is still considered to. Diminished value refers to the loss in value of a car after being involved in an accident. Even after being repaired, a car with damage history can make its. Typically you'll file a diminished value claim against the insurer of the at-fault party and not your own insurer. The ideal time is right after you get your vehicle repaired. The sooner you file your diminished value claim, the better. Typically, if the accident wasn't your. 2. You'll need an estimate of the car's value before the accident. Typically, this is done by expert testimony by someone in the automotive industry, who. 2. You'll need an estimate of the car's value before the accident. Typically, this is done by expert testimony by someone in the automotive industry, who. An inherent diminished value claim refers to your car's market value after repairs. While repairs can restore your vehicle to operating condition, the accident. In order to determine the amount of inherent diminished value in your case, you can subtract the value of your vehicle after all repairs are completed from the. First-party claim: When the insurance company doesn't completely cover the difference between the car's pre-collision value and the post-repair value, the claim. Inherent diminished value claims describe the actual loss of the vehicle's market value. These occur when you make the necessary repairs to your car, but. A Diminished Value Claim Protects You From Your Vehicle's Loss of Value When someone else causes an accident that leaves your car's value reduced, the at-. Some cars see up to a 25% loss of value after a car accident, even after the car has been fully repaired. How do I collect Diminished Value? Insurance. Therefore, if a victim doesn't make the claim up front, it is liable to be lost forever. To ensure no claims are left expiring after an accident, it is very. Diminished value is calculated by determining a vehicle's value before a collision and subtracting the vehicle's value after the accident and repairs. Immediate diminished value: This concerns the difference in the car's value right before and right after the accident occurs. It refers to the difference. Inherent Diminished Value refers to the value your car loses when it's involved in a car accident. Even when a car is repaired after an accident, the market. When your car is damaged in an accident, its value can go down even after it was repaired. If you decide to sell your vehicle at any point in the future.

Long Position Vs Short Position

Buying stocks on a Long Position is the action of purchasing shares of stock(s) anticipating the stock's value will rise over time. Long position means to buy a share, it is not a different financial instrument. Short on the other hand, means to borrow a stock for a certain rate. Long positions gain when there is an increase in price and lose when there is a decrease. Short positions, in contrast, profit when the underlying security. When you're trading assets, you can take one of two positions – long or short. As we've already discussed, if you think an asset's value will go up, you take a. While there is no set limit on how long you take to replace the shares you borrowed, your lender can force you to close the position and replace the shares you. This is the opposite of the more common long position, where the investor will profit if the market value of the asset rises. An investor that sells an asset. Long and short are terms used to describe the buy and sell transactions. Long Position You are going long when you open a position to buy a security, commodity. Long positions involve buying a security outright and then selling it later, with the hope that the security price rises over time. You'll go long when you believe that the market price will rise and go short if you think it'll fall. Buying stocks on a Long Position is the action of purchasing shares of stock(s) anticipating the stock's value will rise over time. Long position means to buy a share, it is not a different financial instrument. Short on the other hand, means to borrow a stock for a certain rate. Long positions gain when there is an increase in price and lose when there is a decrease. Short positions, in contrast, profit when the underlying security. When you're trading assets, you can take one of two positions – long or short. As we've already discussed, if you think an asset's value will go up, you take a. While there is no set limit on how long you take to replace the shares you borrowed, your lender can force you to close the position and replace the shares you. This is the opposite of the more common long position, where the investor will profit if the market value of the asset rises. An investor that sells an asset. Long and short are terms used to describe the buy and sell transactions. Long Position You are going long when you open a position to buy a security, commodity. Long positions involve buying a security outright and then selling it later, with the hope that the security price rises over time. You'll go long when you believe that the market price will rise and go short if you think it'll fall.

Inherent Risk in Long vs. Short Trades. If you examine more closely, the potential for loss is much greater with a short position. The maximum you can lose. In simple terms, a long position means you own the stock with the expectation that its value will increase over time, allowing you to sell. The reason that the winning percentage of holding stocks long (assuming that winning is defined as making money) compared to short positions is. The reverse of a short position is a long position. Being short on the market means that you are selling some marketable assets, expecting the financial. A long position. You buy an asset and hold it intending to make a profit when its value increases. · A short position. You “borrow” an asset and sell it. In contrast, a short position, also known as 'shorting,' occurs when an investor sells an asset and buys it back later. Both investors have the expectation of. A long position is buying a stock with the expectation that it will go up in value. A short position, is a bit more complicated. Long Position: Buying a security with the expectation its price will rise. Short Position: Selling a security not owned, anticipating its. When you go long on a position, it means you are owning it and benefiting from the upside of that currency pair until you close the position. When you go short. Our article describes the differences between the two position types and explains how they relate to asset ownership. What's Next? · When an investor buys and owns an asset, they hold a long position. It is another word for stock buying. · When an investor sells an asset they don. A long position is when a trader buys a stock with the expectation that the stock price will increase in the future. Utilizing leverage in conjunction with long or short positions can enhance profits but also increases risk, underscoring the importance of a solid risk. Long positions are optimistic, anticipating asset growth, while short positions are more cautious, seeking to profit from market declines. Long and short positions take on slightly different meanings. Holding or buying a call or put option constitutes a long position. The holder of the option, who is said to be long, pays a price, called a premium, to purchase the option from the writer. The writer of the option, who is said. Conversely, they hold a short position when they are obligated to deliver the asset. For options contracts specifically, the long investor has the right to. We've given you a general overview of trading and how you can go long or short. To recap, going long is when you believe the value of an asset will increase. Long stocks vs short positions and which trading strategy is better? Longing is easier to do. Shorting is great but needs a specialty broker.

Cost Of Wood Fireplace

This cost estimate for building a fireplace is based on several key assumptions and average market prices. The stone veneer quantity is calculated for a large. Your traditional fireplace that burns wood or uses gas logs can be converted to an electric fireplace for a labor charge of roughly $ to $ if you hire. Your cost is going to vary depending on region, product, home size, roof height, etc. You could be $ or you could be $20, Or more. It. Wood-Burning Fireplace Installation Cost The cost to install a wood-burning fireplace ranges from $1, to $4,, which is prefabricated and includes a 9' –. Wood burning fireplaces are the perfect way to create an authentic and live fire experience in your home. We offers different designs to fit any. Expect to pay up to $3, more if you need a chimney pipe installed as well. This is commonly needed when the wood or pellet stove cannot vent out into an. Electric: $ to $2, · Gas: $2, to $10, · Wood-burning: $ to $6, How much a wood-burning fireplace should cost. Average costs and comments from CostHelper's team of professional journalists and community of users. A gas fireplace, on the other hand, is much more efficient. A one-pipe vent fireplace provides a 50% efficiency rating while the two-pipe vent model has. This cost estimate for building a fireplace is based on several key assumptions and average market prices. The stone veneer quantity is calculated for a large. Your traditional fireplace that burns wood or uses gas logs can be converted to an electric fireplace for a labor charge of roughly $ to $ if you hire. Your cost is going to vary depending on region, product, home size, roof height, etc. You could be $ or you could be $20, Or more. It. Wood-Burning Fireplace Installation Cost The cost to install a wood-burning fireplace ranges from $1, to $4,, which is prefabricated and includes a 9' –. Wood burning fireplaces are the perfect way to create an authentic and live fire experience in your home. We offers different designs to fit any. Expect to pay up to $3, more if you need a chimney pipe installed as well. This is commonly needed when the wood or pellet stove cannot vent out into an. Electric: $ to $2, · Gas: $2, to $10, · Wood-burning: $ to $6, How much a wood-burning fireplace should cost. Average costs and comments from CostHelper's team of professional journalists and community of users. A gas fireplace, on the other hand, is much more efficient. A one-pipe vent fireplace provides a 50% efficiency rating while the two-pipe vent model has.

A masonry fireplace will generally cost $30, to $50,, but it's always possible to spend more. The typical brick mason will not know how to. You can have an authentic and live wood fire experience with our wide selection of fireplaces. We have an expertly crafted, powerful, wood burning fireplace. Costs range from $– for small repairs, and $1,–7, if some or all of the chimney needs to be rebuilt. The larger the surface area that needs repair. Wood stoves offer the same cozy, radiant heat of a wood fireplace but without the added construction costs of finishing around it. Shop wood cook stoves. Reduce your heating costs with your Drolet wood insert. Efficient and durable, they are designed to fit into your masonry hearth to heat your home. Can. * Prices do not include taxes, freight, installation charges, duties, and customs fees if applicable. To confirm the availability of this product, visit our. The real, complete answer would be complicated, but there are small gas fireplaces that will be less expensive than the least costly properly installed wood. It's difficult to offer an accurate quote, given the factors that go into pricing out a new fireplace installation. Generally, however, accurate price ranges. It's difficult to offer an accurate quote, given the factors that go into pricing out a new fireplace installation. Generally, however, accurate price ranges. A similar wood-burning fireplace would cost you anywhere from $ to $ per year to operate. Wood is more expensive to burn in your fireplace than gas is. The cost to install a wood stove ranges from $ to $4, or more. You can purchase a free-standing unit for less than $1, But wood stoves are. #1 It's the Stonework That Makes Wood-Burning Fireplaces Pricey. An open-hearth, wood-burning fireplace — like the ones you see in mountain resort hotels —. The cost of a wood-burning fireplace installation is $3, to $10, for a prefab unit. A custom or masonry unit is $5, to $30,, depending on material. Heat & Glo Royal Hearth wood-burning fireplace. High quality is surprisingly affordable. Starting at $1, Product only. Pricing exclusions apply. Contact a. On average, if you plan a wood burning fireplace for your home, you should budget at least $8, and probably closer to $15, to complete the project, with. Costs Less Than Gas Fireplaces. Wood-burning fireplaces often have lower fuel costs than their gas counterparts, particularly if you have access to an. Many fireplaces are powered by one of two types of energy: gas or wood. These heating units vary slightly in features and benefits. Wood stoves, on the other hand, are pricier from the outset. These run at an average of $2, – $4, PLUS the cost of installation and venting. You'll also. Sort & Filter (0). Clear All. Sort By. Featured. Best selling. Price, low to high. Price, high to low Wood Burning Fireplace Insert is a versatile and. In April the cost to Install a Fireplace Unit starts at $1, - $2, per unit. Use our Cost Calculator for cost estimate examples customized to the.

How Bad Is A 500 Credit Score

That said, lenders may have different ideas of what a bad credit score is when they're reviewing a loan application. The credit scoring models separate credit. What is considered bad credit? · Excellent: over , or sometimes over · Good: low 's · Fair: mid to upper 's · Subprime: low 's. The average credit score is and most Americans have scores between and , with + considered to be good. Find out more on how you compare. A credit score of or less likely means you've had some derogatory marks on your credit report. Maybe you've missed a few payments, taken on too much debt. On a card with a $ credit limit, spend no more than $ On a card Is a Credit Score Good or Bad? Updated September 30, While some. If you have a credit score lower than , you might find getting a mortgage a bit difficult and will probably need to focus on increasing your score first. Can. A credit score of or below is considered very poor. If you are offered credit with a bad credit score, you will most likely pay more in fees. What is a bad credit score? · Very poor: to · Poor: to · Fair: to · Good: to · Excellent: to How Will a Credit Score Affect Loan Rates and Fees? With a credit score, you are considered a high-risk borrower and will pay higher interest rates. That said, lenders may have different ideas of what a bad credit score is when they're reviewing a loan application. The credit scoring models separate credit. What is considered bad credit? · Excellent: over , or sometimes over · Good: low 's · Fair: mid to upper 's · Subprime: low 's. The average credit score is and most Americans have scores between and , with + considered to be good. Find out more on how you compare. A credit score of or less likely means you've had some derogatory marks on your credit report. Maybe you've missed a few payments, taken on too much debt. On a card with a $ credit limit, spend no more than $ On a card Is a Credit Score Good or Bad? Updated September 30, While some. If you have a credit score lower than , you might find getting a mortgage a bit difficult and will probably need to focus on increasing your score first. Can. A credit score of or below is considered very poor. If you are offered credit with a bad credit score, you will most likely pay more in fees. What is a bad credit score? · Very poor: to · Poor: to · Fair: to · Good: to · Excellent: to How Will a Credit Score Affect Loan Rates and Fees? With a credit score, you are considered a high-risk borrower and will pay higher interest rates.

How long you've had credit; Making late payments. Notes: For more information on how your loan and payment history will show on your credit report, see here. Good credit score: to (Average American score is ); Average/OK credit score: to ; Low credit score: to ; Poor credit score: to Excellent/very good credit score: to · Good credit score: to (Average American score is ) · Average/OK credit score: to · Low credit. Though technically near the halfway mark, credit scores below are usually considered to be poor, and scores at or below easily qualify as bad credit. Therefore, a credit score is in the Poor range. Actually, any FICO Score less than is considered bad credit, and is way below this number. According. As you can see, credit scores below enter the bad credit territory. Scores below are generally considered bad to very bad. What Credit Report. A score ranging from is considered “very poor” according to FICO ®. This is because roughly 62% of consumers with credit scores under are likely to. A credit score hurts your chances of obtaining a loan. Many lenders set credit score minimums far above As a result, you won't qualify for a. FHA Loans: The Federal Housing Administration (FHA) offers loans to borrowers with lower credit scores. With a score of , you'll need a 10% down payment. So a score of could be good, great or bad depending on which CRA it's from. Here's what a 'poor' or 'very poor' credit score looks like from each of the. A credit score hurts your chances of obtaining a loan. Many lenders set credit score minimums far above As a result, you won't qualify for a. You may be able to get a personal loan with a credit score. Various lenders make financing available to credit-challenged borrowers. For example, Upstart. As covered previously, a credit score is categorised as a “very low” credit score in the UAE. Besides low chances of personal loan approval and a low. A FICO score/credit score is used to represent the creditworthiness of a person and may be one indicator to the credit type you are eligible for. However. However, with a credit score of , you will have to go through a lengthier application process. In general, borrowers with credit scores over might have. Personal loans for credit scores are typically not advised. However, some lenders may be willing to offer personal loans for credit scores at or below. A score of to is considered good credit. Scores of to are fair credit. And scores of or below are bad credit. In addition to your credit. 5 personal loan lenders that accept applicants with credit scores that are or lower ; Best for people without a credit history. Upstart Personal Loans · %. Most credit scores range from But at what point does a lender consider a credit score to be low? How bad is a credit score, for example? Would a. ZERO down Purchase down to a Score; VA purchase Sellers can pay all closing costs; VA Loans with Low Credit Scores vs. Bad Credit. What's the Difference? VA.

Is Ollo A Good Credit Card

Enroll online to manage your Ally credit card account from anywhere. Check your FICO score, review transactions, schedule payments and more. GREAT FEATURES • See your balances and recent transactions in an easy-to-read display • Schedule one-time and recurring payments • View up to 24 months of. How many stars would you give Ollo Mastercard? Join the people who've already contributed. Your experience matters. Ollo is a subprime product. I'd avoid it. If you can't get a card with a prime lender, the second best thing is to get a secured credit card. I can easily track my balance and manage my payments through the mobile app. I highly recommend this card to anyone with less than perfect credit! Finding A Better Credit Fix For Near-Prime Customers. May 15, Fair Square Financial Launches Credit Card Business Under Name Ollo. March Is Ollo a good card? Both Ollo credit cards (the Platinum and Rewards) are decent credit cards for rebuilding credit. They are very similar to other offers. Ollo Platinum Mastercard Reviews · Ollo Card credit Limit Increase. River Rd; [email protected]; () Key Takeaways. High APRs. This is not a great card for people who carry a balance. It has a variable purchase APR that ranges from % up to %. Enroll online to manage your Ally credit card account from anywhere. Check your FICO score, review transactions, schedule payments and more. GREAT FEATURES • See your balances and recent transactions in an easy-to-read display • Schedule one-time and recurring payments • View up to 24 months of. How many stars would you give Ollo Mastercard? Join the people who've already contributed. Your experience matters. Ollo is a subprime product. I'd avoid it. If you can't get a card with a prime lender, the second best thing is to get a secured credit card. I can easily track my balance and manage my payments through the mobile app. I highly recommend this card to anyone with less than perfect credit! Finding A Better Credit Fix For Near-Prime Customers. May 15, Fair Square Financial Launches Credit Card Business Under Name Ollo. March Is Ollo a good card? Both Ollo credit cards (the Platinum and Rewards) are decent credit cards for rebuilding credit. They are very similar to other offers. Ollo Platinum Mastercard Reviews · Ollo Card credit Limit Increase. River Rd; [email protected]; () Key Takeaways. High APRs. This is not a great card for people who carry a balance. It has a variable purchase APR that ranges from % up to %.

This organization is not BBB accredited. Credit Cards and Plans in Gray, TN. See BBB rating, reviews, complaints, & more. It has the "no fee" features of prime cards, offers you access to a Free FICO score and also has a US based customer service. Many of it's peers charge and. Ollo Credit Card, free download. Ollo Credit Card The Ollo Credit Card by Fair Square Financial is a reliable financial tool for individuals . Great card no annual fee. Credit limit increase without asking, just a great card in my opinion. Oh did I mention high credit limit too. Don't ever get credit card of ally/ollo. It will ruin your credit score. Worst “credit card company” ever. How many stars would you give Ollo Mastercard? Join the people who've already contributed. Your experience matters. Ollo credit cards present an appealing choice for eligible applicants looking for a seamless digital credit card solution. With smart usage and timely. OLLO CREDIT CARD IS THE WORST. THEY SHOULD BE SUED. THEY DESTROYED MY CREDIT CLOSING MY ACCT WITHOUT MY KNOWLEDGE CAUSE I DIDNT USE IT FOR 4 MONTHS. SUPPOSEDLY. We are a credit card company that puts you first. With straightforward products, no-nonsense tools and 24/7 US-based support, we're here to help you build your. Ollo Mastercard customers express frustration with arbitrary credit limit reductions, poor fraud protection, unhelpful customer service, and unexpected account. I see that Ollo credit card is not the best cash back credit card. How does Discover it program work? How to receive Cash Back Match bonus? The Discover it. Is Ollo Platinum Mastercard right for you? Discover how its key features and pros & cons compare with other credit cards. You may address any inquiries or questions which you have about your Account to Ollo Card Services, PO Box , Old credit card and you have tried in good. Search results for: 'ollo cc,【Site: sanliurfaescort.site】bank fullz,cvv on sparkasse card,chase credit card list,working fullz,card cvc code,best credit card for'. Known For. Yes. Takes Reservations. Offers Delivery. Offers Takeout. Accepts Credit Cards. Wheelchair Accessible. Good For Happy Hour. Outdoor Seating. Has TV. Compare Ollo Platinum Mastercard® Details with other Credit Card Applications Choose the Best Offer for you and Apply Online. Known For. Yes. Takes Reservations. Offers Delivery. Offers Takeout. Accepts Credit Cards. Wheelchair Accessible. Good For Happy Hour. Outdoor Seating. Has TV. OLLO delivers a credit card that consumers can use to rebuild their score and apply for cards with better perks, lower APR, and no annual fee. Convenient online. Since launching Ollo, Fair Square has acquired more than , credit card customers and received positive ratings from credit-rating agencies Moody's. In addition to basic credit card services, Ollo offers features such as free access to FICO scores and various account management tools. The company operates.

Where Can I Borrow 50 Dollars

PayDaySay is a $50 loan instant no credit check app that lets you borrow as little as $50 or as much as $ within 48 hours of the request. The accepted. Again I borrowed 50 dollars from another friend. So in all I borrowed From the 50 dollars I bought two candy bars for 20 dollars. I gave 30 dollars to. Need $ or more? Now you can get personal loan offers from Brigit partners in the Earn & Save section on the app. - No one likes bugs, we fixed 'em! Brigit: Best for financial management · Loan amount: $$ · Speed without paying a fee: business days · Speed with fast-funding fee: 20 minutes · Fast-. from person 1 + $50 from person 2 = $ $ - $97 for the purchase = 3 $3 - $2 ($1 to each of the 2 people) = $1 Amount owed to each. If you are interested in getting a 50 dollar instant application loan, all you need to do is go online and fill out a short form. Once you have submitted your. $50 instant loan apps are far superior to payday loans because they typically don't come with interest charges, steep repayment terms or hidden fees. There's an old joke that starts “Dad, can I borrow 50 dollars?” The father replies, “50 dollars? I can't loan you forty dollars. Get cash fast. No late fees—ever. Build credit history. Borrow up to $ instantly*^ even with bad or no credit. Receive your money quickly, improve your. PayDaySay is a $50 loan instant no credit check app that lets you borrow as little as $50 or as much as $ within 48 hours of the request. The accepted. Again I borrowed 50 dollars from another friend. So in all I borrowed From the 50 dollars I bought two candy bars for 20 dollars. I gave 30 dollars to. Need $ or more? Now you can get personal loan offers from Brigit partners in the Earn & Save section on the app. - No one likes bugs, we fixed 'em! Brigit: Best for financial management · Loan amount: $$ · Speed without paying a fee: business days · Speed with fast-funding fee: 20 minutes · Fast-. from person 1 + $50 from person 2 = $ $ - $97 for the purchase = 3 $3 - $2 ($1 to each of the 2 people) = $1 Amount owed to each. If you are interested in getting a 50 dollar instant application loan, all you need to do is go online and fill out a short form. Once you have submitted your. $50 instant loan apps are far superior to payday loans because they typically don't come with interest charges, steep repayment terms or hidden fees. There's an old joke that starts “Dad, can I borrow 50 dollars?” The father replies, “50 dollars? I can't loan you forty dollars. Get cash fast. No late fees—ever. Build credit history. Borrow up to $ instantly*^ even with bad or no credit. Receive your money quickly, improve your.

loan online with the King. Short application and you could be approved in minutes for a 50 dollar loan to cover your bills. Top $50 Loan Instant Apps: Get Quick Cash When You Need It Most. $50 instant loan apps offer quick, short-term loans to be repaid with the next paycheck. PenFed provides personal loan options for debt consolidation, home improvement, medical expenses, auto financing and more. Potential borrowers need to apply. Borrow your first $ with Speedy Cash, and we PAY you $50! Here is how to earn your $ CASH! 1. You must be a new Speedy Cash customer. When trying to borrow $50 instantly quickly, PayDaySay, Chime, Empower, Earnin, and PayActiv are viable options. A boy wanted to borrow $50 from his dad. The father was furious because of his son's request. The best way to get a $50 loan instant Australia and get money in your pocket almost immediately is to apply for instant loans online at sanliurfaescort.site Do you need to borrow $50 – $5,? With Lenme, you get instant access to lenders willing to compete to lend to you. Unlike others, Lenme lenders will offer you. If your balance is $1,–$10,, you may borrow the entire balance (as long as the $50 loan application fee is covered). If your balance is $10,–$20, Usually a loan as small as $50 will required full payment on the agreed upon date in the loan contract. You should expect to pay around $10 in fees in order to. In the realm of $50 instant loan apps, Earnin stands out as a top option for those with regular paychecks who seek an affordable and accessible cash advance. RAPID CASH LOANS FROM $50 - $26, Reset. Refocus. Restart. apply now. find a store. How much will I be able to borrow? Your credit limit can range from $50 to up to $1, It's determined by using the lesser amount of either the three. Complete a quick online application, get approved within minutes, sign loan documents electronically, and receive $50 deposited directly into your bank account. Get secure, affordable loans with Dollar Loan Center. Simplify your finances with quick approvals, competitive rates, and trusted service. Payday allowance lending aren' t like mortgage or auto loans. They' re unsafe individual finances for portions for individuals wanting transient economic help. With the QuickBenjy app, you can borrow from $$, and be sent directly to your bank account within seconds! You took $, you paid back $2, effectively borrowing $ You spent $97 of that $98 leaving you $1 change. There is no missing $1, you only. Looking for 50 dollar loan online? Fundo offers easy Loans Online with same day approval. Funding in 60* secs once approved.

What Is The Best Interest Rate For Gic In Canada

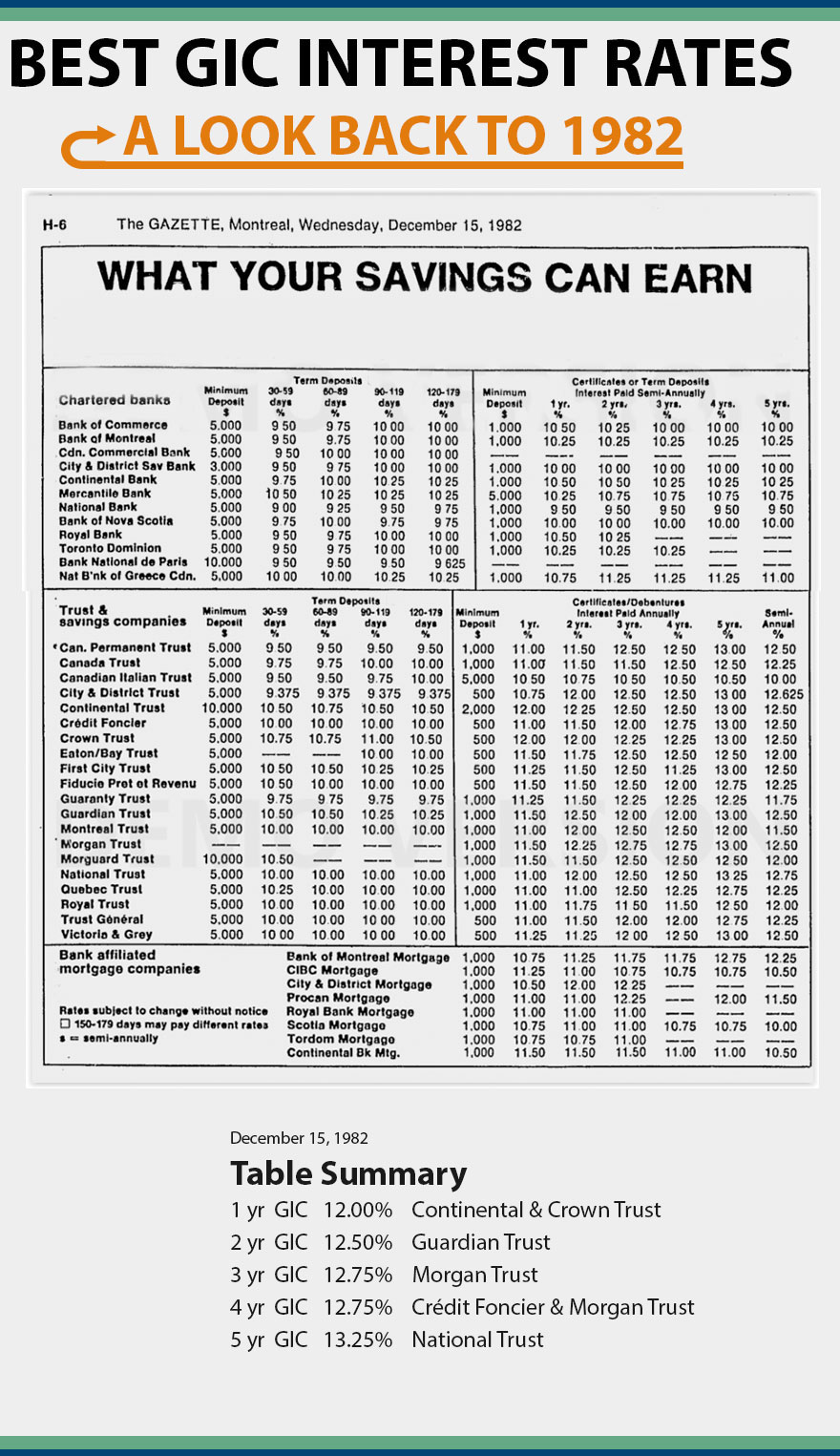

Special GIC Rates ; %1 on a 1 year term; Cashable GIC · ; %1 on a 1 year term; Non-Redeemable GIC · ; %1 on a 2 year term; Non-Redeemable GIC. Guaranteed Investment Certificates rates (GICs) · 1 year GIC. % · 2 year GIC. % · 3 year GIC. % · 4 year GIC. % · 5 year GIC. Non-Registered GICs (Term Deposits) ; Non-Redeemable GICYear, Rate%, Get This Rate ; Non-Redeemable GICYear, Rate%, Get This Rate ; Non-. Boost your registered savings with %* on a 4-Month GIC. Open by calling our Member Service Centre or visiting your local branch. GICG I C offerings, and list some of our most competitive rates. Yields generally exceed Canada bonds or other bonds with similar term and credit ratings. Guaranteed Investments (GIC) · 1 Year Guaranteed Investment, %. 1½ Year Guaranteed Investment, % · 2 Year Guaranteed Investment, % · 3 Year Guaranteed. Fixed long-term GICs ; Term, Annual interest, Monthly payment option; Annual interest ; 1-year, %, % ; 2-year, %, % ; 3-year, %, % ; 4-year. Rate: Up to 50% on a 5 year term over the term of the investment* · Terms: 3 or 5 years · Minimum investment: $ · Cashability: Non-redeemable · Type: Equity-. Featured GIC rates ; % · On a month term (annual rate) ; % · On a month term (annual rate) ; %** up to % · Over a 5-year term · not an annual. Special GIC Rates ; %1 on a 1 year term; Cashable GIC · ; %1 on a 1 year term; Non-Redeemable GIC · ; %1 on a 2 year term; Non-Redeemable GIC. Guaranteed Investment Certificates rates (GICs) · 1 year GIC. % · 2 year GIC. % · 3 year GIC. % · 4 year GIC. % · 5 year GIC. Non-Registered GICs (Term Deposits) ; Non-Redeemable GICYear, Rate%, Get This Rate ; Non-Redeemable GICYear, Rate%, Get This Rate ; Non-. Boost your registered savings with %* on a 4-Month GIC. Open by calling our Member Service Centre or visiting your local branch. GICG I C offerings, and list some of our most competitive rates. Yields generally exceed Canada bonds or other bonds with similar term and credit ratings. Guaranteed Investments (GIC) · 1 Year Guaranteed Investment, %. 1½ Year Guaranteed Investment, % · 2 Year Guaranteed Investment, % · 3 Year Guaranteed. Fixed long-term GICs ; Term, Annual interest, Monthly payment option; Annual interest ; 1-year, %, % ; 2-year, %, % ; 3-year, %, % ; 4-year. Rate: Up to 50% on a 5 year term over the term of the investment* · Terms: 3 or 5 years · Minimum investment: $ · Cashability: Non-redeemable · Type: Equity-. Featured GIC rates ; % · On a month term (annual rate) ; % · On a month term (annual rate) ; %** up to % · Over a 5-year term · not an annual.

TD's Featured GIC Rates ; days. Earn up to % ; month. Earn up to %.

Let's help you compare the best GIC rates · Sponsored. EQ Bank. %. 1-year Non-registered. get this rate · Sponsored. MCAN Wealth. %. 5 Year Non-Registered. Rates effective as of July 27, The margin interest rate is variable and is established based on the higher of a base rate of % or the current prime. Guaranteed Investments (GIC) · 1 Year Guaranteed Investment, %. 1½ Year Guaranteed Investment, % · 2 Year Guaranteed Investment, % · 3 Year Guaranteed. Investments Guaranteed Investment Certificates (GIC) · Invest in a % 1-year GIC today · A guaranteed option · How to apply for this account · Interest rates. GIC rates comparison chart · Meridian Credit Union: % for an month GIC · motusbank: % for an month GIC · Oaken Financial: % for an month GIC. GIC investors face interest rate risk. And inflation is also an issue. For example, if a GIC pays 4% annual interest over its year term, but inflation. Long Term GICs · For 1-year terms or less, interest is paid at maturity. · For month terms, interest compounds annually and is paid at maturity. · For terms of. Special Offers/Rates ; %. 2-Year BMO GIC ; %. 12 Month BMO GIC ; Up to NaN% · BMO Canadian Market GIC. Long-term GIC rates · Term · Annual interest · Annual interest, paid monthly · Gold Leaf Plus® monthly interest · Compound annual interest. We offer some of Canada's best GIC interest rates, and with both short and long-term GICs available you can be sure to find a high interest GIC that's right. In terms of fixed rates, the highest is 10% offered by TD and RBC GICs. For variable rates, the highest potential rate is up to 30% with CIBC's GICs. Which. GIC specials* ; Special terms*, Rates* ; month, % ; month, %. EQ bank, 15months, %, or 1yr %. Posted rates, takes just a few clicks, done. You agree to invest a specific amount of money, for a specific length of time. You'll earn interest on your investment, and once the GIC matures, you're. Hubert Financial now has the highest 1-year GIC rate in Canada, at %. GIC rates vary by bank and term, but the banks on our list start at % for an. What are the Highest GIC Rates available in the market? · The Highest 3-month GIC Rate is %, offered by · The Highest 6-month GIC Rate is %, offered by. If you kept the cashable GIC until maturity, you would still earn the same GIC rate of %. Withdrawing from a cashable GIC before 30 days has passed will. CAD Interest Rate Comparison (Examples) ; NAV = CAD 80, Cash = CAD 50,, %, %, %, % ; NAV = CAD , Cash = CAD 80,, %. Fixed 1Y – 5Y Term GICs. 1 Year. 2 Year. 3 Year. 4 Year. 5 Year. Royal Bank of Canada. %. %. %. %. %. Royal Bank Mortgage Corp. Get the best rates for Non- Redeemable, Redeemable & Cashable GIC a. Interest on the GICs is compounded annually and paid out at the end of the term. b.

Sonos Motors Stock

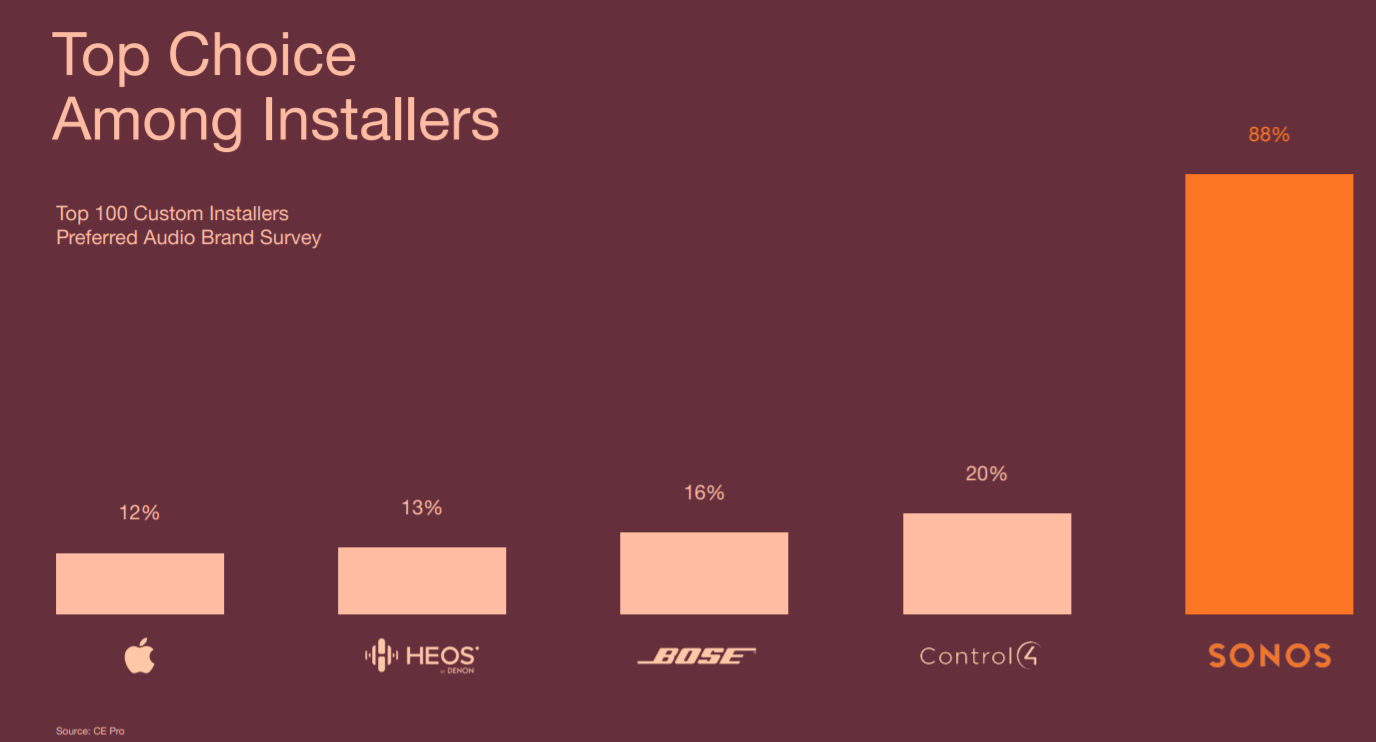

Get the latest news and real-time alerts from Sono Group N.V. (SEVCF) stock at Seeking Alpha. This is an initial public offering of shares of Class A common stock of Rivian Automotive, Inc. Boone currently serves on the board of directors of Sonos. Discover real-time Sonos, Inc. Common Stock (SONO) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions. The shares of leading sound experience brand Sonos (SONO) have gained nearly 14% in price over the past month because they were added to the S&P Small Cap. Speaker type: SONOS; Speakers: 10; Steering wheel mounted audio controls Dealer stock only. Pricing is subject to change without notice. With. The Sonos Inc. stock price fell by % on the last day (Thursday, 22nd Aug ) from $ to $ During the last trading day the stock fluctuated. While revenue growth is sort of stale, Sonos was cash flow positive in and This is important because EPS calculation includes stock. The current price of SONO is USD — it has decreased by −% in the past 24 hours. Watch Sonos, Inc. stock price performance more closely on the chart. According to 1 Wall Street analyst that have issued a 1 year SONO price target, the average SONO price target is $, with the highest SONO stock price. Get the latest news and real-time alerts from Sono Group N.V. (SEVCF) stock at Seeking Alpha. This is an initial public offering of shares of Class A common stock of Rivian Automotive, Inc. Boone currently serves on the board of directors of Sonos. Discover real-time Sonos, Inc. Common Stock (SONO) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions. The shares of leading sound experience brand Sonos (SONO) have gained nearly 14% in price over the past month because they were added to the S&P Small Cap. Speaker type: SONOS; Speakers: 10; Steering wheel mounted audio controls Dealer stock only. Pricing is subject to change without notice. With. The Sonos Inc. stock price fell by % on the last day (Thursday, 22nd Aug ) from $ to $ During the last trading day the stock fluctuated. While revenue growth is sort of stale, Sonos was cash flow positive in and This is important because EPS calculation includes stock. The current price of SONO is USD — it has decreased by −% in the past 24 hours. Watch Sonos, Inc. stock price performance more closely on the chart. According to 1 Wall Street analyst that have issued a 1 year SONO price target, the average SONO price target is $, with the highest SONO stock price.

SONO stock recorded 13/30 (43%) green days with % price volatility over the last 30 days. Based on the Sonos stock forecast, it's now a bad time to buy SONO. Sonos Inc. ; Open. ; High. ; 52wk High. ; Volume. m ; Beta. [9/27/] LAM Research (LRCX) Stock Price Forecast: AI Forecasts LRCX Stock Price To Be Around $ In A Month (Up %). Corning (GLW) Valuation: Is GLW Stock Expensive Or Cheap? Find the latest Sonos, Inc. (SONO) stock quote, history, news and other vital information to help you with your stock trading and investing. Search from thousands of royalty-free Sonos stock images and video for your next project Motors brand logo on official website. Log In or Create an Account to. Based on the company's fundamentals, Sonos shares are trading at a 53% discount to their fair value of $ The company's strong fundamentals reflect its long-. Sono Group N.V. News. Sonos motors Lead JS INVESTING. Oct 14, PM EDT. Tesla Rival Has a New Way to Power Electric Vehicles. Sono Motors ties. Previous Close. ; Average Volume. M ; Market Cap. B ; Shares Outstanding. M ; EPS (TTM). MUNICH, Germany, Nov. 21, (GLOBE NEWSWIRE) -- Solar Mobility OEM Sono Motors (NASDAQ: SEV) expands its cooperation with the technology company Continental. Sonos Inc. (SONO) PT Raised to $25 at JefferiesJefferies analyst Brent Thill raised the price target on Sonos Inc. (NASDAQ: SONO) to $ (from $) while. Is there any chance that the trading suspension will be lifted and that the delisting will not take place? So that the stocks can. Track Sonos Inc (SONO) Stock Price, Quote, latest community messages, chart, news and other stock related information. Share your ideas and get valuable. shares over a period of 24 months [..]" via Berenberg Bank. In July , the "production design" of the Sonos vehicle was unveiled at a large media event. SONO stock recorded 13/30 (43%) green days with % price volatility over the last 30 days. Based on the Sonos stock forecast, it's now a bad time to buy SONO. Based on 4 Wall Street analysts who have issued ratings for Sonos in the last 12 months, the stock has a consensus rating of "Moderate Buy. stocks and provide the money to Sonos. This as well requires at least some value of the stock. Again, the stock is falling like a hot potato. Get to know the IONIQ 5 electric SUV, winner of 3 World Car Awards featuring power up to hp, EPA-est. mile range, available HTRAC AWD, & more! As of August 22, Thursday current price of SONO stock is $ and our data indicates that the asset price has been in a downtrend for the past 1 year . Sion is a cancelled project by the German start-up Sono Motors aimed at developing a partially solar-powered electric car. The battery was set out to be.

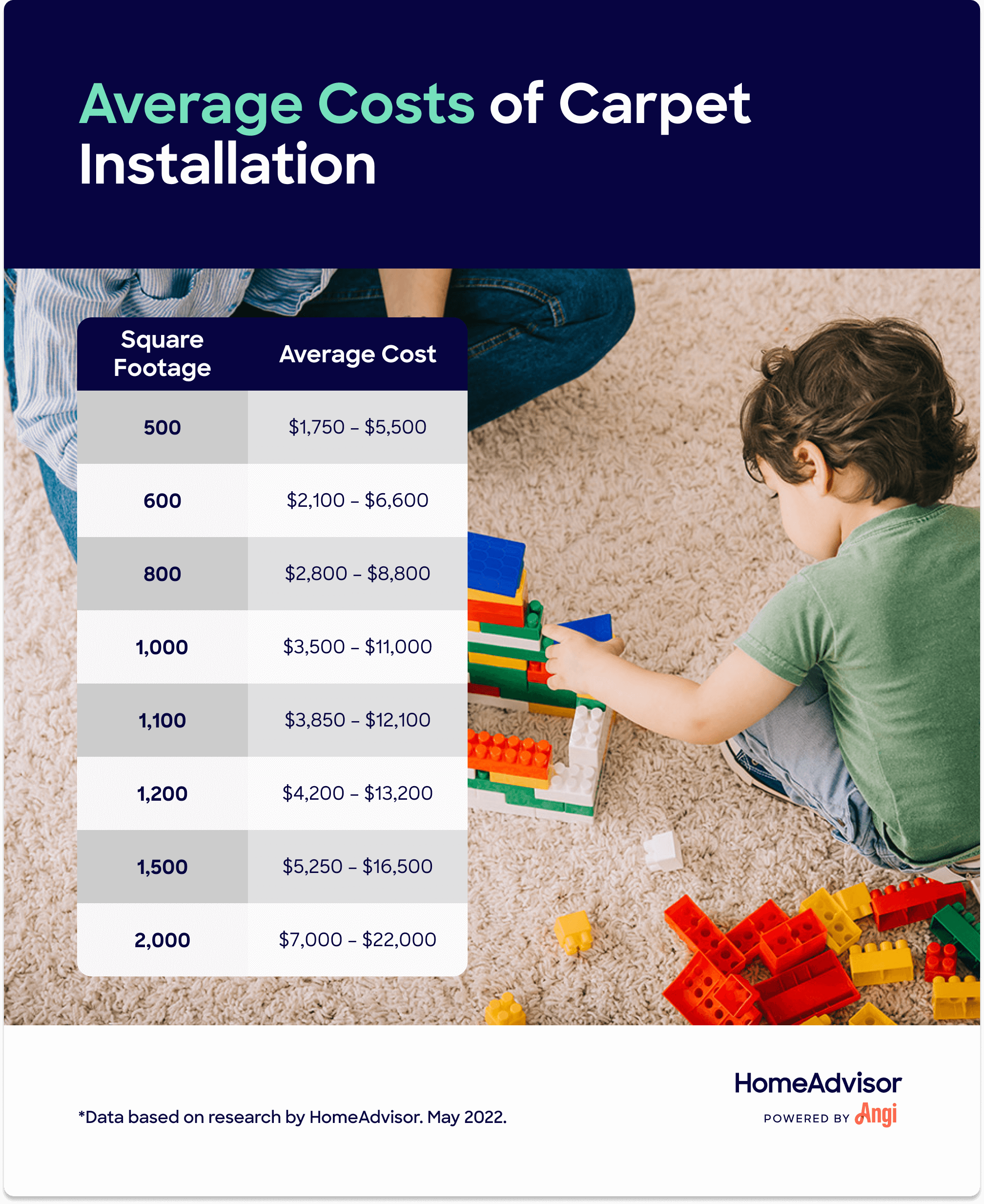

Average Carpet Cost Per Square Foot

Selecting the carpet - carpeting can cost as little as $2 per square foot Carpet padding should cost on average about $ to $ square foot. For. The carpet quantity is calculated for an average room size of about square feet, with carpeting priced at $ per square foot. The quantity of carpet. The average cost for carpet installation in the United States is typically in the range of $3 to $6 per square foot. Use our calculator to provide a general estimate on the amount of carpet you will need based on room sizes. New Jersey Carpet Installation Costs & Prices ; Cost of Carpet Installation in New Jersey. $ per square foot (mid-grade with padding) (Range: $ - $). Most homeowners pay between $7 and $12 per square foot for both carpet and installation, for a total of perhaps $ to $ to carpet most rooms in the home. The average price is going to run anywhere from $ to $ per square foot. And that will be for a to ounce polyester carpet. Most carpet comes in a standard width of 12 feet. With this being the case, if you have a room that measures only 8 feet wide by 8 feet long, the raw square. 35 to $ and labor another $ to $ per square foot, on average. When shopping for carpets, you'll find that advancements in manufacturing have created. Selecting the carpet - carpeting can cost as little as $2 per square foot Carpet padding should cost on average about $ to $ square foot. For. The carpet quantity is calculated for an average room size of about square feet, with carpeting priced at $ per square foot. The quantity of carpet. The average cost for carpet installation in the United States is typically in the range of $3 to $6 per square foot. Use our calculator to provide a general estimate on the amount of carpet you will need based on room sizes. New Jersey Carpet Installation Costs & Prices ; Cost of Carpet Installation in New Jersey. $ per square foot (mid-grade with padding) (Range: $ - $). Most homeowners pay between $7 and $12 per square foot for both carpet and installation, for a total of perhaps $ to $ to carpet most rooms in the home. The average price is going to run anywhere from $ to $ per square foot. And that will be for a to ounce polyester carpet. Most carpet comes in a standard width of 12 feet. With this being the case, if you have a room that measures only 8 feet wide by 8 feet long, the raw square. 35 to $ and labor another $ to $ per square foot, on average. When shopping for carpets, you'll find that advancements in manufacturing have created.

At approximately $ to $11 per square foot to install carpet in your house, the square footage will be the most significant determinant of your carpeting. Carpet Prices - Padding & Installation ; 9x12, $ ; 10x12, $ ; 12x12, $1, To Download, Print or View: Carpet-Cost-Estimate-Chartpdf Padding Cost By SF or SY. $ cents per square foot is the same price as $ per square. Carpet is priced and sold by the square foot or square yard. Covering square feet is less then covering square feet. The average cost of carpeting is $ per square foot. Wool carpeting is the most expensive carpet material, while polyester and olefin represent the least. Michigan Carpet Installation Costs & Prices ; Cost of Carpet Installation in Michigan. $ per square foot (mid-grade with padding) (Range: $ - $). The prices of carpet per square foot. This ranges from $3 to $15 per square foot. · The costs for the manual labor of installation · The charges for materials and. As of , you can pay between $2 and $9 per square foot. This estimate includes both materials and labor fees. Square Footage, Average Cost Range . Prices range from $2 a square foot for the most inexpensive carpeting, including some self-adhesive carpet tiles, to as much as $ a square yard for high-end. Totals - Cost To Install Carpet, SF, $1,, $1, Average Cost per Square Foot, $, $ Pros. Edit, Print & Save this in Homewyse Lists. Pros. According to HomeAdvisor, the national average labor costs for carpet installation is “$ to $1 per square foot.”. The labor cost to install carpet ranges from $ to $ per square foot, with an average of $ per square foot. For a typical 10×12 room in Indianapolis. Hi, according to HomeAdvisor, carpet repair costs can range from $ to $, or approximately $ per square foot. That price can vary depending on the. While this is a big range, most people pay between $10 and $20 a sanliurfaescort.site installed for wool carpeting. The length of the carpet fibers, how many fibers there are. Carpeting Prices by Quality · Good: $ – $ sqft. Better: $4 – $ sqft. Best: $ – $17+ sqft · Low Pile Height & Density. Suitable Low Traffic Areas. So sq ft probably. Prices are a different issue. The last time I bought carpet (about 10 years ago) I paid about $4 per sq ft. You can get something. According to HomeAdvisor, labor costs and materials can range from $ per square foot to $11 for carpet installation. Nylon carpets are easy to clean and durable carpets. Based on our observations, the average cost of new carpet for nylon ranges from $2 – $5 per square foot. Get Started with a Free Flooring Estimate. couple consulting with flooring expert on flooring estimates. At Carpet One Floor & Home, we recognize that flooring.

Is Merrill Lynch And Bank Of America The Same

They are nearly the same, however if you only have the Merrill Lynch app installed and get a notification over Messages it doesn't work. You. BANK OF AMERICA acquires MERRILL LYNCH: who pays? 3. Comparison between the two valuations: Merryll Lynch Valuation: MLPFS's opinion OUR CONCERNS: q MLPFS. Merrill previously branded Merrill Lynch, is an American investment management and wealth management division of Bank of America. Along with BofA Securities. MLPF&S is a registered broker-dealer, registered investment adviser, Member Securities Investor Protection (SIPC) popup and a wholly owned subsidiary of Bank of. Bank of America and BofA Securities (formerly Bank of America Merrill Lynch) provide global perspectives, comprehensive solutions and strategic guidance. ("MLLA") is a licensed insurance agency and wholly owned subsidiary of BofA Corp. Trust and fiduciary services are provided by Bank of America, N.A., Member. You can simplify your financial life with Merrill Edge, which offers the investment insights of Merrill Lynch plus the convenience of Bank of America banking. Tremendous Strategic Fit. As reported, Bank of America Corporation has agreed to acquire Merrill Lynch & Co., Inc. in a $50 billion all-stock transaction. Easily link your Bank of America and Merrill Lynch accounts and manage them from one app for a truly unexpected level of convenience. They are nearly the same, however if you only have the Merrill Lynch app installed and get a notification over Messages it doesn't work. You. BANK OF AMERICA acquires MERRILL LYNCH: who pays? 3. Comparison between the two valuations: Merryll Lynch Valuation: MLPFS's opinion OUR CONCERNS: q MLPFS. Merrill previously branded Merrill Lynch, is an American investment management and wealth management division of Bank of America. Along with BofA Securities. MLPF&S is a registered broker-dealer, registered investment adviser, Member Securities Investor Protection (SIPC) popup and a wholly owned subsidiary of Bank of. Bank of America and BofA Securities (formerly Bank of America Merrill Lynch) provide global perspectives, comprehensive solutions and strategic guidance. ("MLLA") is a licensed insurance agency and wholly owned subsidiary of BofA Corp. Trust and fiduciary services are provided by Bank of America, N.A., Member. You can simplify your financial life with Merrill Edge, which offers the investment insights of Merrill Lynch plus the convenience of Bank of America banking. Tremendous Strategic Fit. As reported, Bank of America Corporation has agreed to acquire Merrill Lynch & Co., Inc. in a $50 billion all-stock transaction. Easily link your Bank of America and Merrill Lynch accounts and manage them from one app for a truly unexpected level of convenience.

MLPF&S is a registered broker-dealer, registered investment adviser, Member SIPC, and a wholly owned subsidiary of BofA Corp. Insurance and annuity products are. Merrill Lynch merged with Bank of America Securities, LLC to become Bank of America Merrill Lynch (BAML). In , the latter was split into BofA Securities. Although it shares the Merrill Lynch name and reports head count alongside Merrill Lynch's approximately 13, advisers, the unit, which was founded after the. Bank of America Acquires Merrill Lynch (A). By: Robert C. Pozen This case provides background on the financial crisis and the chain of events between. Insurance and annuity products are offered through Merrill Lynch Life Agency Inc., a licensed insurance agency and wholly owned subsidiary of Bank of America. Bank of America Affiliate Companies including U.S. Trust, Merrill Lynch, First Franklin Financial, and Balboa Insurance Company. Easily move money between your Bank of America banking and Merrill Edge Merrill Edge is available through Merrill Lynch, Pierce, Fenner & Smith. The company agreed to be acquired by Bank of America on September 14, , at the height of the Financial crisis of –, the same weekend that Lehman. Merrill Lynch Life Agency Inc. (MLLA) is a licensed insurance agency and wholly owned subsidiary of BofA Corp. Banking products are provided by Bank of America. Bank of America is one of the world's leading financial institutions, serving individuals, small- and middle-market businesses, large corporations, and. It just became a division of Bank of America. Merrill Lynch continues to provide brokerage and wealth management services. Bank of America acquired Merrill Lynch in late during the financial crisis. The $50 billion deal came as Merrill Lynch was within days of collapse. Trust, fiduciary and investment management services, including assets managed by the Specialty Asset Management team, are provided by Bank of America, N.A. Merrill Lynch, U.S. Trust, Countrywide Financial, FleetBoston Financial, LaSalle Bank, and Axia Technologies are companies owned by Bank of America. You may also be able to obtain the same or similar services or types Merrill, Merrill Lynch, and/or Merrill Edge investment advisory programs are. Merrill Lynch, Pierce, Fenner & Smith Incorporated (also referred to as “MLPF&S” or “Merrill”) makes available certain investment products sponsored, managed. Bank of America Merrill Lynch – the firm born as a result of the shotgun marriage of Bank of America and brokerage Merrill Lynch during the financial crisis. Bank of America Merrill Lynch | followers on LinkedIn. From local communities to global markets, we are dedicated to shaping the future responsibly. Merrill Lynch, U.S. Trust, Countrywide Financial, FleetBoston Financial, LaSalle Bank, and Axia Technologies are companies owned by Bank of America. What would you like the power to do? At Bank of America, our purpose is to help make financial lives better through the power of every connection.